Your New Heights® IUL policy

Flexibility to help meet your needs, in every stage of life

Legacy Protection and Tax-Advantaged Growth

Take care of your loved ones and preserve your estate

If you pass away unexpectedly, Nationwide New Heights® Indexed Universal Life Accumulator 2020 (New Heights IUL) can help make sure your family has the resources to help maintain their standard of living, pay off mortgages or other debts, and carry out education plans for your children.

It also can be used as a tax-free estate-planning strategy that allows you to efficiently preserve and pass wealth on to your heirs or favorite charity, or to help you protect any business interests.1

Build and protect a source of future income

New Heights IUL offers you the flexibility to choose from a fixed interest strategy and a wide range of indexed interest strategies – or any combination of the strategies – that allow for growth potential to help you reach your accumulation goals. Your risk tolerance can change over time. New Heights IUL lets you update your allocations of premium and cash value across the various indexed and fixed interest strategies to best suit your financial situation.

Index Options

New Heights IUL includes a unique blend of growth opportunities to help you accumulate more assets for future income. Exclusive global and domestic indexed interest strategies incorporate momentum and diversification investing principles, and offer the opportunity for more consistent returns in a variety of market conditions. A 0% minimum floor rate ensures your cash value is always protected from any negative index performance.

More detailed information is available in Index and Strategy Options, or ask your financial professional to see the New Heights IUL rate sheet.

The power of protected growth

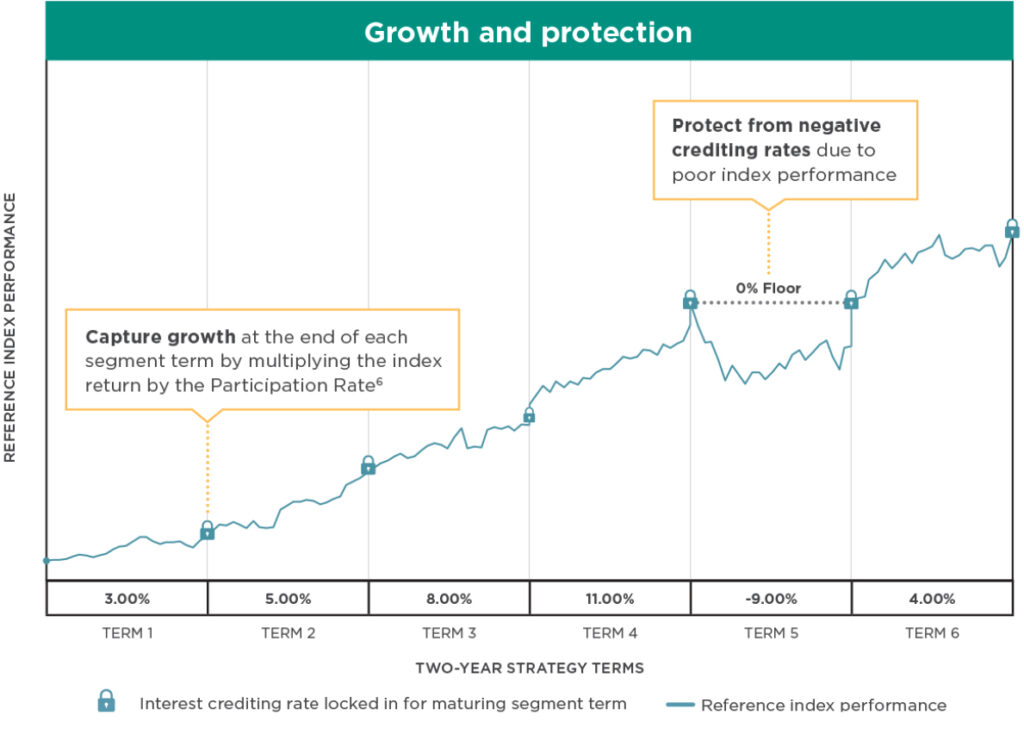

New Heights IUL provides growth opportunities based on the positive performance of the indexed interest strategies you choose. The portion of your premium allocated to each strategy is an individual segment term that lasts one to two years. The hypothetical chart below shows how a crediting rate is determined in different markets.

The hypothetical graph above assumes a single premium amount and two-year segment terms. It is intended for informational purposes only and does not depict the actual performance of any New Heights IUL policy or indexed interest strategy.

IUL policies are not stock market investments and do not directly participate in any stock or equity investments.

Enhanced accumulation opportunities and services

Nationwide IUL Rewards Program® – once requirements are met, additional interest is credited at an annualized rate of 0.30% starting in year 16 (sooner for older issue ages). The credit is applied monthly, as long as the policy is in force; includes pro rata interest on any accumulated value taken from an index segment for loans or partial withdrawals (assumes the segment is not depleted).3

Automated Income Monitor – New Heights IUL offers an exclusive service that can help you take income efficiently based on when and how you want to take it.4 You can specify if you want to receive your income monthly, quarterly or annually based on your needs.

Additional tax benefits

No penalties to access funds prior to age 59½ – with New Heights IUL, any interest credited to your policy is tax-free. There are no penalties for accessing funds before age 59½, or taxes when moving funds between indexed interest strategies.5

Tax-free income through loans and withdrawals – once cash value has accumulated in your policy, you can easily access it via policy loans and withdrawals.6

1 Please contact a legal professional for advice on structuring the policy for charitable giving and estate-planning purposes.

2 Other factors, such as a cap or spread rate, are available in some indexed interest strategies.

3 Net accumulated premium (total premium paid minus any policy loans, unpaid loan interest, and partial withdrawals) must equal or exceed the required premium amount at the start of policy year 16. The required premium is set at issue but may change if policy changes are made.

4 With Automated Income Monitor, selecting the dollar amount of withdrawals will influence their duration (how long they last). Likewise, selecting a duration will influence the amount of the withdrawal. Either way, we will provide you the details and send you an annual update to keep you informed. Taking income out of your policy will reduce its cash value and may increase the chance it will lapse. If you plan to rely on your policy for income, ask your financial professional about using the Overloan Lapse Protection Rider to help keep your policy from lapsing.

5 If you pay too much premium, your policy could become a modified endowment contract (MEC). Distributions from an MEC may be taxable.

6 Loans and withdrawals from the cash value may affect the death benefit and may require the need for additional premiums. If you choose to take loans or withdrawals, the cash value and the death benefit payable to your beneficiaries will be reduced.

If you surrender all or part of the policy, the surrender may be subject to income taxes and surrender charges may apply.

This material is not a recommendation to buy, sell, hold or roll over any asset, adopt an investment strategy, retain a specific investment manager or use a particular account type. It does not take into account the specific investment objectives, tax and financial condition or particular needs of any specific person. Investors should discuss their specific situation with their financial professional.

This policy allows for flexible premium payments, but it’s important to adequately fund it to keep it in force and to help meet your needs and those of your beneficiaries.

Indexed universal life insurance policies are not stock market investments, do not directly participate in any stock or equity investments, and do not receive dividends or participate in capital gains. Past index performance is no indication of future crediting rates. Also, be aware that interest crediting fluctuations can lead to the need to pay additional premium to meet your goals and/or prevent the policy from lapsing. Be sure to choose a product that meets long-term life insurance needs, especially if personal situations change – for example, marriage, birth of a child or job promotion. Weigh the costs of the policy and understand that life insurance has fees and charges that vary with sex, health, age and tobacco use. Riders that customize a policy to fit individual needs usually carry an additional charge.

All guarantees and benefits of the insurance policy are backed by the claims-paying ability of the issuing insurance company. They are not backed by the broker/dealer and/or insurance agency selling the policy, or by any of their affiliates, and none of them makes any representations or guarantees regarding the claims-paying ability of the issuing insurance company. Nationwide and its representatives do not give legal or tax advice. An attorney or tax advisor should be consulted for answers to specific questions.

The J.P. Morgan MOZAICSM Index (USD) (“Index”) has been licensed to Nationwide Life and Annuity Insurance Company (the “Licensee”) for the Licensee’s benefit. Neither the Licensee nor Nationwide New Heights® Indexed Universal Life (IUL) Accumulator 2020 (the “Product”) is sponsored, operated, endorsed, recommended, sold or promoted by J.P. Morgan Securities LLC (“JPMS”) or any of its affiliates (together and individually, “JPMorgan”). JPMorgan makes no representation and gives no warranty, express or implied, to contract owners taking exposure to the Product. Such persons should seek appropriate professional advice before making any investment. The Index has been designed and is compiled, calculated, maintained and sponsored by JPMS without regard to the Licensee, the Product or any contract owner. JPMorgan is under no obligation to continue compiling, calculating, maintaining or sponsoring the Index. JPMorgan may independently issue or sponsor other indices or products that are similar to and may compete with the Index and the Product. JPMorgan may also transact in assets referenced in the Index (or in financial instruments such as derivatives that reference those assets). These activities could have a positive or negative effect on the value of the Index and the Product.

The NYSE® Zebra Edge® Index has been licensed to Nationwide Life and Annuity Insurance Company (“Nationwide”). Neither Nationwide nor the Nationwide New Heights® Indexed Universal Life (IUL) Accumulator 2020 (the “Product”) is sponsored, operated, endorsed, recommended, sold or promoted by Zebra, NYSE or UBS and in no event shall Zebra, NYSE or UBS have any liability with respect to the Product or the Index. Zebra, NYSE and UBS make no representations, give no express or implied warranties and have no obligations with regard to the Index, the Product, the client or other third party. The marks NYSE®, and NYSE Arca® are registered trademarks of NYSE Group, Inc., Intercontinental Exchange, Inc. or their affiliates. The marks Zebra® and Zebra Edge® are trademarks of Zebra, may not be used without prior authorization from Zebra, and are being utilized by NYSE under license and agreement.

The “S&P 500” is a product of S&P Dow Jones Indices LLC (“SPDJI”), and has been licensed for use by Nationwide Life and Annuity Insurance Company (“Nationwide”). Standard & Poor’s®, S&P® and S&P 500® are registered trademarks of Standard & Poor’s Financial Services LLC (“S&P”); DJIA®, The Dow®, Dow Jones® and Dow Jones Industrial Average are trademarks of Dow Jones Trademark Holdings LLC (“Dow Jones”); and these trademarks have been licensed for use by SPDJI and sublicensed for certain purposes by Nationwide. Nationwide New Heights® Indexed Universal Life (IUL) Accumulator 2020 is not sponsored, endorsed, sold or promoted by SPDJI, Dow Jones, S&P, their respective affiliates, and none of such parties make any representation regarding the advisability of investing in such product(s) nor do they have any liability for any errors, omissions, or interruptions of the S&P 500.

Products are issued by Nationwide Life and Annuity Insurance Company, Columbus, Ohio. Nationwide, the Nationwide N and Eagle, Nationwide is on your side, Nationwide New Heights, Nationwide IUL Rewards Program are service marks of Nationwide Mutual Insurance Company. Third party marks that appear in this document are the property of their respective owners.

Policy Form #: ICC 18-NWLA-558

Nationwide New Heights IUL Accumulator 2021

FLW-0159AO.1 (10/20)